LG CEO William Cho Highlights Consistent Progress Towards Future Vision 2030

Driving Business Portfolio Innovation to Maximize the Potential of Key Business Areas

and Advance B2B, Platform-Based and Emerging Ventures

SEOUL, Aug. 21, 2024 — LG Electronics (LG) is rapidly evolving into a “Smart Life Solution Company” by leveraging its decades of customer insight, manufacturing expertise and technological prowess as a leader in home appliances. As part of its mid- to long-term strategy, “Future Vision 2030,” LG is committed to ongoing transformation and growth.

On August 21, LG hosted an investor forum at LG Sciencepark in Seoul, bringing together domestic and international investors and analysts. During the event, CEO William Cho outlined the company’s progress and strategic direction since the announcement of Future Vision 2030 last year, emphasizing key achievements. The forum was also streamed live on LG’s YouTube channel.

In addition to CEO William Cho, the event was attended by CFO Kim Chang-tae, CSO Lee Sam-soo and other top executives responsible for key business areas such as heating, ventilation and air conditioning (HVAC), webOS content & services and subscription business. The event aimed to communicate the progress and plans of LG’s mid- to long-term strategy directly to the market, ensuring greater transparency.

Following the announcement of the 2030 Future Vision and the shareholders’ meeting, LG continues to engage with the market and stakeholders through direct communication from the CEO and key business leaders, as demonstrated in this investor forum.

Under the Future Vision 2030 plan, LG aims to become a “Smart Life Solution Company” by connecting and enhancing customer experiences across various living spaces, including homes, commercial environments, mobility and virtual platforms. To achieve this, the company plans to accelerate the transformation of its business portfolio towards a more future-oriented model. The goal is to achieve the “Triple Seven” targets: a 7 percent average growth rate, 7 percent operating profit and an enterprise multiple (EV/EBITDA) of 7.

At the event, LG shared its interim financial progress under Future Vision 2030, revealing an 8 percent increase in revenue, a 6 percent operating profit and a fourfold growth in EV/EBITDA compared to the previous year, based on the first half of this year’s business performance (excluding LG Innotek).

“Over the past year, we have been steadily laying the foundation for achieving our future vision, and we take pride in creating ‘structural changes’ and ‘sustainable outcomes’ in various areas,” said CEO Cho. “With strong confidence and a sense of responsibility, we will continue to advance towards our goals.”

Four Strategic Directions for Business Portfolio Innovation

CEO Cho detailed LG’s approach to business portfolio innovation, focusing on four key directions: maximizing the full potential of existing key businesses, expanding platform-based service models, accelerating the growth of B2B and fostering New-to-LGE businesses.

The first direction of maximizing the full potential of current businesses involves a strategy to overcome the limitations of mature core businesses, such as home appliances and TVs. This includes integrating subscription services into its home appliance offerings and expanding direct-to-consumer (D2C) sales channels, providing customers with more choices and enhanced experiences.

CEO Cho explained that these efforts are leading to steady growth and profit generation in core businesses, which serve as cash cows for the company. Despite a double-digit decline in the Korean home appliance market, LG’s domestic appliance sales are on the rise, driven by the creation of new demand through subscription services. In addition, overseas home appliance sales have grown more than 1.5 times faster than the market average over the past three years, driven by expanded product and price lines and D2C sales.

Second, expanding platform-based service models focuses on leveraging the hundreds of millions of LG products sold worldwide as a platform to generate revenue from content, advertising and services. A prime example is LG Home Entertainment Company’s TV business, which aims to accelerate the webOS advertising and content business with the goal of transforming the company into a media and entertainment platform powerhouse. Since 2018, the annual growth rate of the webOS platform-based advertising and content business has reached 64 percent.

In terms of accelerating the growth of B2B businesses, LG is achieving significant results in areas such as vehicle components, HVAC and smart factories. These advancements are closely aligned with market inflection points like digitalization and electrification. LG aims to increase the B2B share of its total revenue to over 45 percent by 2030. The B2B share, which was 27 percent in 2021, has already risen to 35 percent in the first half of this year.

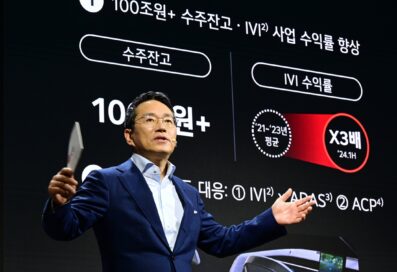

LG’s vehicle component solutions business has secured an order backlog exceeding KRW 100 trillion (USD 74 billion), with sales of high-value products like digital cockpits growing rapidly. The company is also expanding its global production footprint to support this growth. In the HVAC sector, LG leads the high-efficiency market with its advanced inverter and heat pump technologies, and it is actively targeting the cooling systems market for AI data centers, where demand is surging. LG also has plans to expand its smart factory business into industries with rising factory automation needs, such as semiconductors, pharmaceuticals, biotechnology and food & beverages.

The company continues to invest in promising new business areas that will serve as the foundation for future growth. In the commercial robotics sector, LG is focusing on securing AI-driven, software-defined robotics capabilities. For the electric vehicle charging business, LG is collaborating with leading global partners to seize business opportunities.

Portfolio Innovation Yields Emerging Unicorn Ventures

LG also highlighted the success and growth potential of key businesses that have become core engines of the company’s future growth, showcasing significant results from its portfolio innovation.

“Inspired by the term ‘unicorn’ used to describe ventures valued at over KRW 1 trillion (USD 740 million) in the market, we refer to new business models generating annual sales of over KRW 1 trillion (USD 740 million) as ‘unicorn businesses,’” said CEO Cho. “Our home appliance subscription service surpassed KRW 1 trillion (USD 740 million) in annual sales last year, securing its status as a ‘unicorn business.’ Additionally, several seed businesses, which are expected to become the next unicorns in the near future, are accelerating their growth.”

Home Appliance Subscription Business Achieves Unicorn Status

LG is pioneering a paradigm shift in the home appliance business by combining services with its home appliances through a subscription model. Unlike traditional product-centric models that generate one-time sales, the subscription model maintains ongoing customer relationships, offering optimized care services post-purchase, thereby generating continuous revenue.

Last year, the subscription business achieved KRW 1.134 trillion (approximately USD 840 million) in annual revenue, marking a 33 percent growth over the previous year and securing its place as a unicorn business. This growth is accelerating, with revenue expected to rise by nearly 60 percent this year to exceed KRW 1.8 trillion (USD 1.3 billion).

The rapid growth of LG’s home appliance subscription business is driven by its ability to meet diverse customer needs. Customers can lower their initial purchase burden and maintain their appliances in top condition with expert care services for the desired duration, with free services provided during the subscription period. Customer responses highlight the high value of the subscription business, with its share of LG’s domestic home appliance sales rising from 15 percent last year to over 20 percent this year.

webOS-Based Advertising & Content Business Set to Become the Next Unicorn

LG’s webOS-based advertising and content business leverages millions of devices worldwide as a platform to generate additional revenue streams. This year, revenue is expected to exceed KRW 1 trillion (USD 740 million), a fourfold increase compared to 2021. To sustain this rapid growth, LG is focusing on expanding its customer base, diversifying revenue models and strengthening business capabilities.

In platform businesses, the more devices that use the platform, the larger the business scale becomes. LG has sold approximately 220 million smart TVs over the past decade. In addition, LG licenses its webOS to external companies lacking their own operating systems, with non-LG brands having sold over 10 million webOS TVs. The webOS platform is also expanding beyond TVs to include automotive infotainment and smart appliances, with the company securing leading global OEMs as clients for its in-vehicle infotainment systems.

LG provides a variety of content via webOS, operating revenue models based on advertising and services. A prime example is LG Channels, a free, ad-supported streaming service offering over 3,800 channels in 29 countries. LG plans to diversify its services into high-growth areas such as gaming, personalized shopping and Transactional Video On Demand.

To bolster its webOS platform capabilities, LG plans to invest over KRW 1 trillion (USD 740 million) by 2027. The company will continue collaborating with more than 4,000 global content partners and expand tailored advertising solutions through its data analytics subsidiary, Alphonso.

Chiller Business Targets AI Data Center Cooling Market: On Track to Become a Unicorn in Three Years

LG’s HVAC business offers a broad portfolio, ranging from residential air conditioners to commercial systems for large buildings, schools, public institutions and industrial facilities. This is one of LG’s fastest-growing core businesses, driven by market trends like decarbonization and electrification.

The chiller business, which provides cooling solutions for large buildings, has seen new opportunities as global tech giants increase demand for data centers amid the AI boom. Over the past three years, LG’s chiller business has achieved an average annual growth rate of over 15 percent, with overseas sales more than doubling during the same period.

LG plans to leverage its extensive experience in supplying chillers to power plants, data centers and other facilities, along with its high-efficiency core technologies, to actively target the data center cooling market. In addition, LG is preparing to commercialize new solutions, such as liquid immersion cooling, which are gaining traction in the market.

“By 2030, 50 Percent of Total Sales and 75 Percent of Operating Profit Will Come from B2B, Platform-Based and New Businesses”

To achieve its mid- to long-term goals outlined in Future Vision 2030, LG will consistently drive business portfolio innovation. The company aims to generate 50 percent of total sales and 75 percent of operating profit from three key focus areas: expanding platform-based services, accelerating the growth of B2B and nurturing New-to-LGE businesses.

“These goals are rapidly becoming a reality,” said CEO Cho. “We will ensure that LG’s new value proposition is recognized by all stakeholders, securing sustainable growth and profitability over the long term.”

# # #

* Amounts in Korean won (KRW) are translated into U.S. dollars (USD) at the average rate for the six-month period of the year 2024 — KRW 1,349.55 per USD.