Company Showcases Anti-fungal and Antibacterial Glass Powder to

Global B2B Customers

SEOUL, April 17, 2025 — LG Electronics (LG) is accelerating the global expansion of its advanced materials business with LG PuroTecTM, an antimicrobial glass powder designed for diverse B2B applications. The company is targeting global markets – including across Asia – with this innovative material that offers antibacterial and anti-fungal properties.

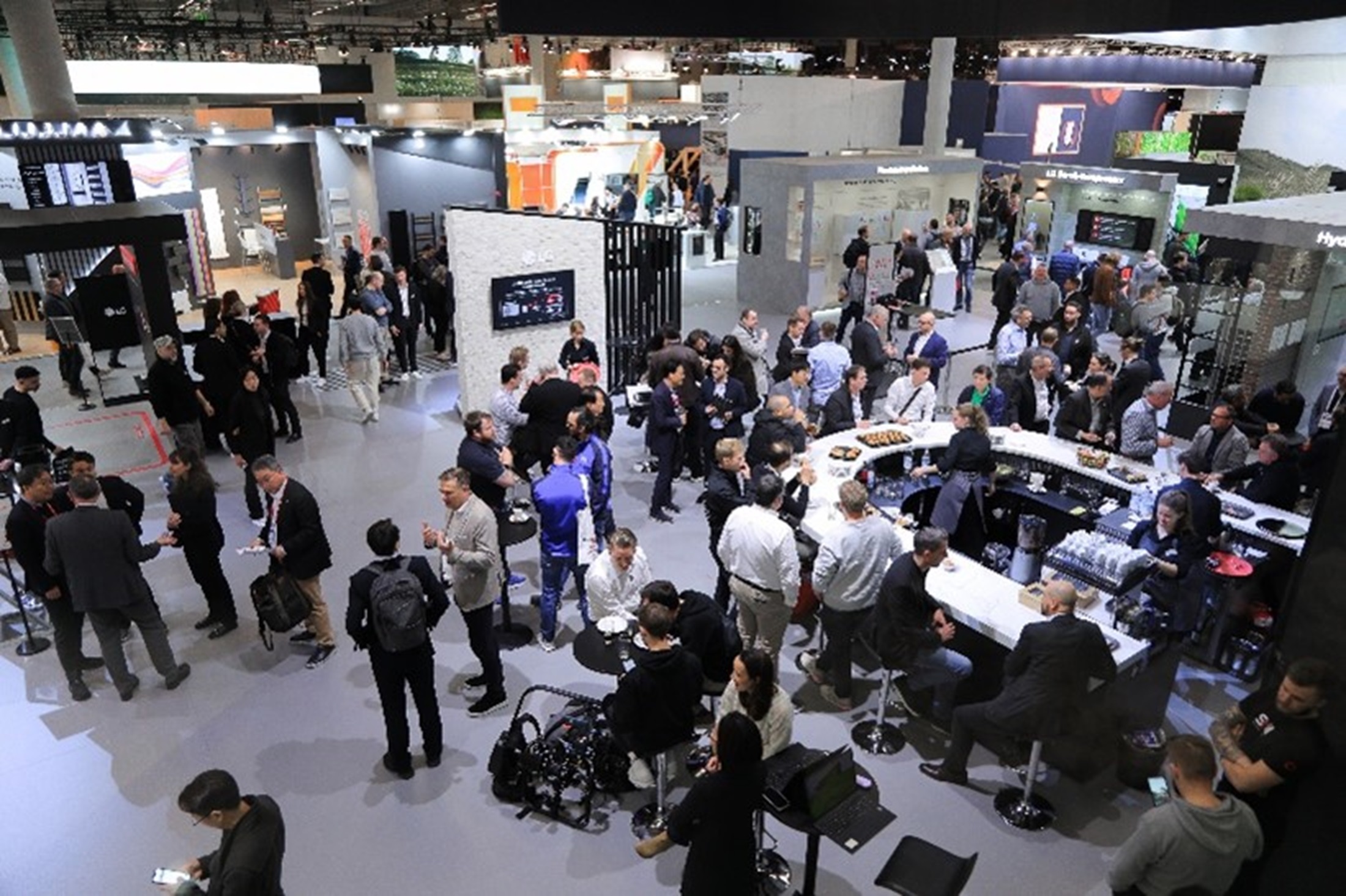

At Chinaplas 2025, being held in Shenzhen, Guangdong, China, LG showcased its lineup of PuroTec to the international B2B market. Recognized as one of the world’s leading industrial materials exhibitions, Chinaplas 2025 has brought together over 4,000 companies from around 150 countries to introduce cutting-edge materials across industries such as plastics and rubber.

At the event, LG highlighted the wide applicability of PuroTec to B2B customers, and also introduced diverse use cases in home appliances, construction materials, medical devices and textiles that PuroTec can be applied to.

PuroTec can be blended into materials like plastic, paint and rubber to provide antibacterial and anti-fungal effects that can help prevent odors, contamination and discoloration caused by microorganisms. Even in small quantities, it maintains excellent efficacy and mixes easily with various base materials, enhancing its value across manufacturing sectors.

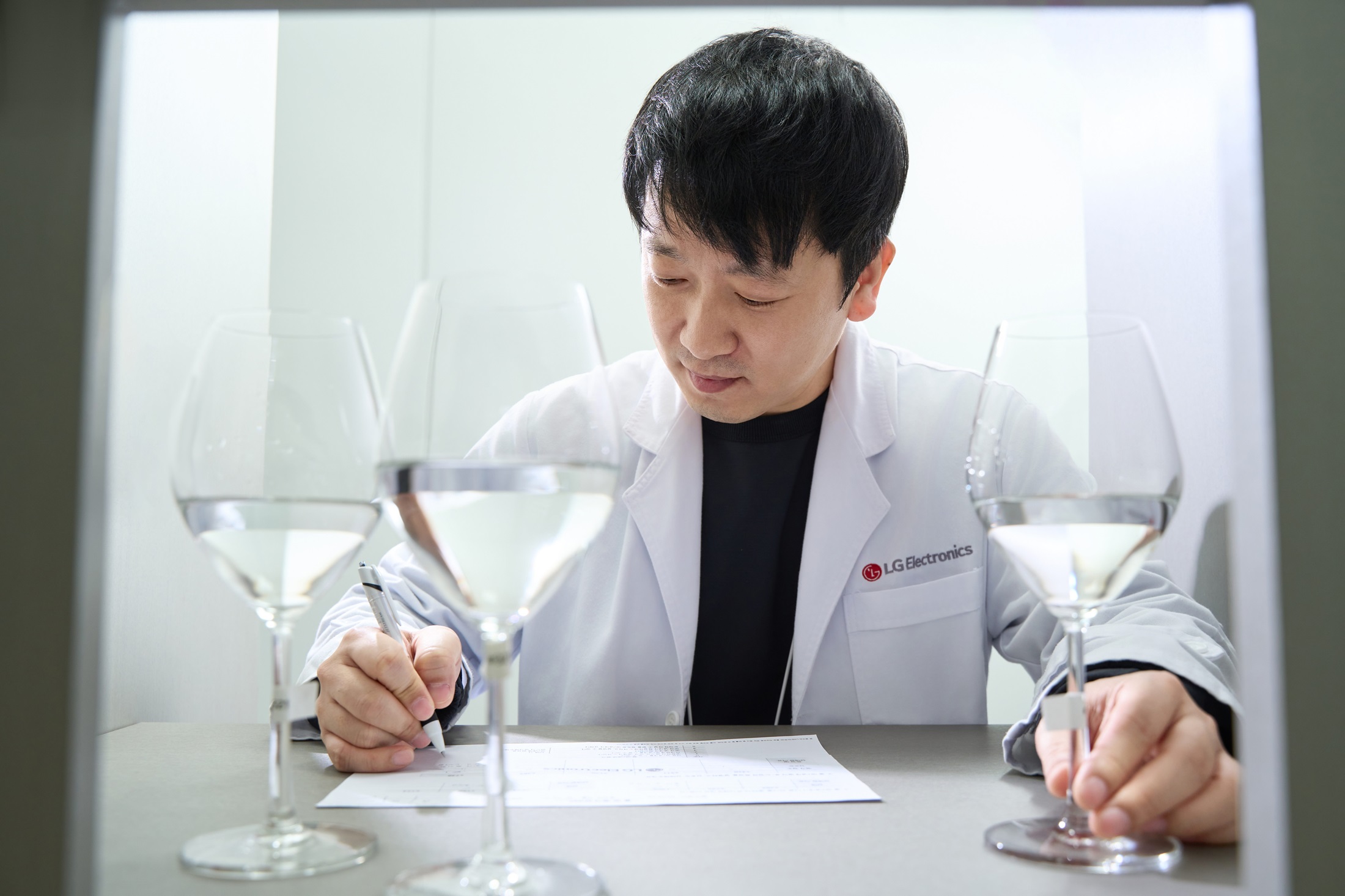

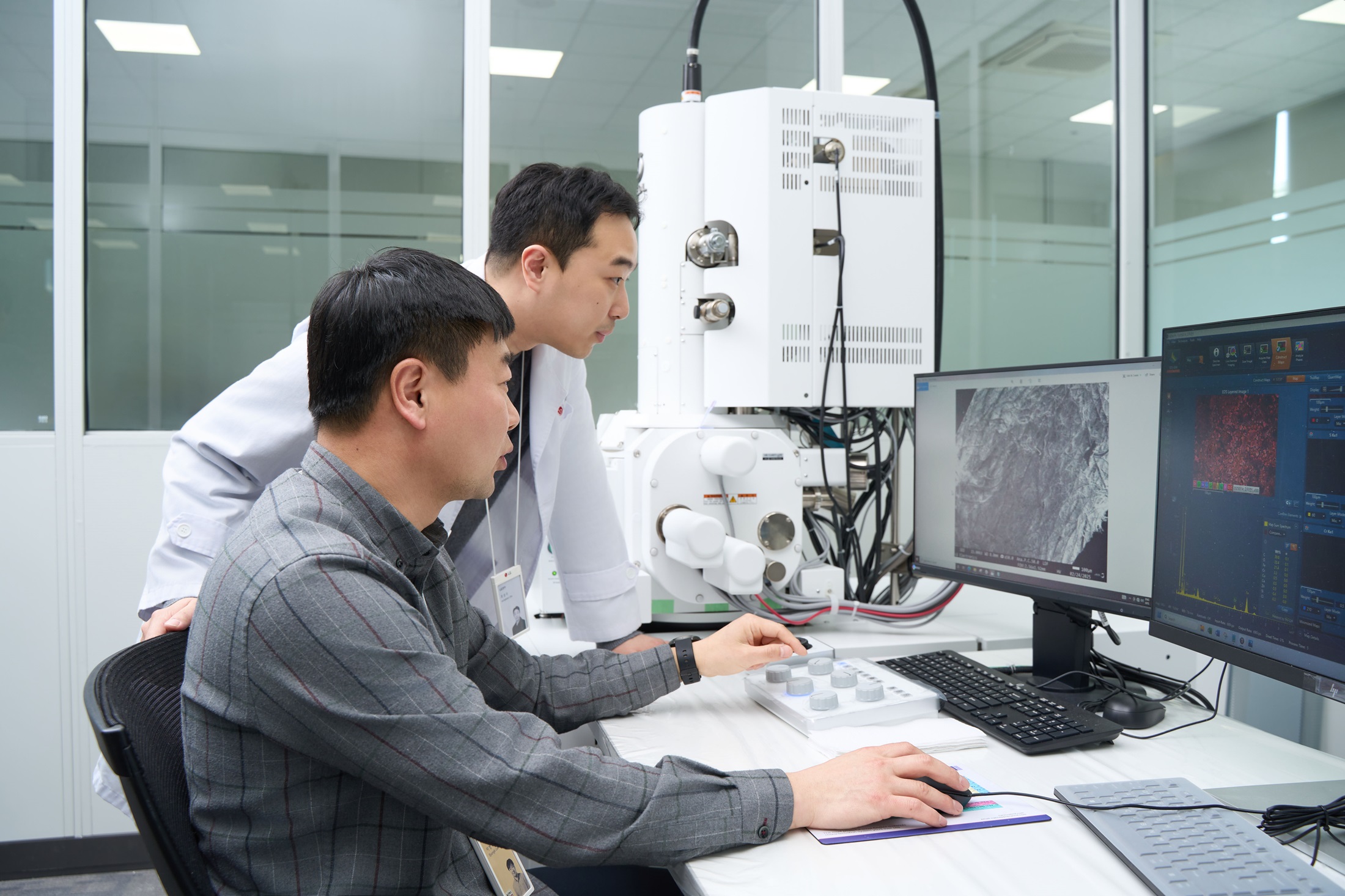

Building on its long-standing expertise in glass powder technology – originally developed for use in its home appliances – LG is positioning PuroTec as a new pillar of its B2B materials strategy. Since introducing the product in 2023, LG has expanded its presence in Asian markets such as China, Vietnam and India, while securing approximately 420 related patents since 2006.

As part of its global expansion strategy, LG plans to introduce PuroTec in Europe and North America, with a major showcase planned at K 2025 in Düsseldorf, Germany, this October.

In addition to PuroTec, LG continues to invest in the development of advanced materials. A notable example is Marine Glass, a functional, water-soluble glass material designed to help support marine ecosystem restoration. When dissolved, it changes into an inorganic ion state that stimulate the growth of both microalgae and macroalgae – helping to rehabilitate damaged ocean environments.

“We will continue to develop advanced materials that meet the evolving needs of global B2B customers,” said Baek Seung-tae, head of the LG’s Kitchen Solution Business, “These innovative solutions will enable us to expand beyond traditional home appliances and into broader, future-forward industries.”

# # #